How to incorporate a company or

representative office in Mongolia?

Despite the fact that Mongolian legislation provides for a wide range of legal forms of commercial entities (limited liability company or LLC, joint-stock company or JSC and joint venture), in practice, private businessmen and foreign investors mostly prefer LLC or JSC. Representative office of foreign legal entities is also common.

Limited Liaility Company (LLC)

An LLC is the most frequently used form of a legal entity established by one or more individuals or legal entities – participants – who are not liable for its obligations while bearing the risk of losses related to the company’s activity to the extent of their personal contributions (participatory interests). The liability of the company is limited to its assets.

There is no minimum charter capital requirement, while participants’ interests are proportional to their contributions. Participants have pre-emption rights on each other’s interests.

The bodies of a limited liability company are:

a) the supreme body of a company shall be the Meeting of Shareholders (MoS).

The MoS, which is held not less than once a year, as the supreme management body of an LLC has exclusive powers with respect to the issues covering business, finance, management, and structure of the company.

b) the executive body of a company (individual or collective).

The day-to-day management of the company is performed by the Director (individual executive body) or Board of Directors (collective executive body), who are elected at the MoS. The authorities entrusted to the Board of Directors shall be specified in the founding documents of the company. The company may also have a Supervisory Board, which is, however, not mandatory.

Limited Liability Company with a foreign investment

According to the law, a foreign investor is defined as “a business entity with an overall equity of US$100,000 or more (or MNT equivalent), where not less than 25% must be owned by (a) foreign investor(s)”. Investments into Mongolia can be made in the following ways:

By establishing a solely or jointly owned business entity;

- through the purchase of a Mongolian companies’ shares, bonds, and other types of securities;

- through merging or wholly acquiring Mongolian and foreign companies;

- through the establishment of franchises or financial leasing; and

- in other ways acceptable and not prohibited by law.

If two or more investors are planning to incorporate a foreign invested LLC in Mongolia, each investor must invest 100,000 USD or MNT equivalent.

Joint-Stock Companies (JSC)

A JSC is a legal entity, which issues shares in order to raise capital for its activities. A JSC may have an unlimited number of shareholders. Shareholders are not liable for the obligations of the JSC, but bear the risks of losses within the value of their shares. A JSC has assets separated from the assets of its shareholders, and shall not be responsible for their obligations.

The JSC is managed by the Meeting of Shareholders (MoS), Board of Directors, and Executive Body.

The MoS is the supreme management body of a JSC, which decides upon the most priority issues such as the company’s management, administration, business policy, corporate structure, financial aspects, elections and some other issues.

The Board of Directors performs overall management of a JSC covering lower priority issues such as finances, policies development and implementation, etc., except for the issues referred by the Law and the Charter to the exclusive competence of the MoS.

The management of current activities shall be performed by the Executive Body. The Executive body may be collective or individual. The Executive Body shall have the right to take decisions on the issues relating to the company’s activities, which are not considered by the laws/legislative of Mongolia and the company's charter as being the competence of other bodies and officials of the company.

Representative Office

Representative offices of foreign legal entities are not deemed to be legal entities, but represent the interests of foreign companies in Mongolia. Being a subdivision of a foreign legal entity, a representative office is not entitled to conduct business activity, which would result in income generation in Mongolia. As a subdivision of a foreign legal entity, a branch may fulfil all or a part of the functions of its parent company.

A representative office operates according to its Charter and is managed by an individual authorised by the parent company under a power of attorney. Representative offices are formed in essentially the same manner as legal entities.

State Registration

1. To establish an LLC in Mongolia, the founder(s) shall take the following steps in accordance with the relevant laws and regulations:

a) Obtaining a company name: The founder(s) or an authorised representative acting under the Power of Attorney shall obtain the name of a LLC from the State Registration Authority. The company name shall meet the following requirements:

-

- not duplicate other companies’ name; and

- be in Cyrillic letters.

When an LLC obtains its name, the founders shall establish the company within 2 months. Otherwise, the verification sheet on the company name will expire in 2 months.

b) Setting up temporary account of the company: Along with obtaining a company name, the founder shall get forms of opening current temporary account(s) for a new company with any commercial bank of Mongolia. This temporary current account is required to deposit for the paid capital of 100, 000 USD or MNT equivalent of a foreign invested company to develop one of the required documents referred to in section (c) below. Once the company is incorporated, with assistance of the founder or appointed Executive Director or any other representative, who is first signatory, the deposited amount can be withdrawn.

c) Development of the documents required for establishment: Pursuant to the Law on State Registration of a Legal Entity, the founder(s) of the foreign invested limited liability company with foreign investments shall prepare the following documents. They are:

-

-

- Application form (UB 12 form);

- Verification sheet on the company name

-

-

- original decision for setting up a foreign invested company with official Mongolian translation;

- founders’ resolution;

- if the founder is a foreign legal entity, it shall issue a separate resolution.

- Charter and shareholders agreement of the company: charter - 2 copies in Mongolian and 1 copy of translation, shareholders agreement - 1 copy with official translation;

- if a company consists of one investor, only the charter is required;

- if a company consists of two or more investors, both charter and shareholders agreement are required and shall be drafted in Mongolian and any other foreign language chosen by investor, then printed in 2 copies each, where each copy of the shareholder agreement shall be notarised;

-

- Meeting minutes of the founders and its Mongolian translation. The Chair of the meeting shall sign on the meeting minutes, if founders are two or more;

- If the founder is a legal entity, a copy of the company incorporation/ registration certificate and a brief company profile is required;

- Bank remittance receipt/Start-up investment threshold, which is 100, 000 USD for each foreign investor;

- Copy of the office lease agreement to confirm the company’s address;

- Copy of the Executive Director’s passport;

- Receipt of payment of the state stamp duty for establishment of a foreign invested LLC, which is 750,000 MNT or approximately 310 USD;

- Power of attorney (if applicable).

After 3-5 business days from submission of the above document, the state registration authority shall register a foreign invested limited liability company in Mongolia.

d) Obtaining the company seal

A foreign invested company shall provide an original copy of the company incorporation certificate to order the company seal. This is the final step of the company incorporation.

The registration of a new foreign invested company in Mongolia takes place with three agencies:

- State Registration Authority;

- District Tax Office; and

- District Social Insurance Office.

Currently, the registration with these agencies takes place separately. The registration for a foreign invested company first goes with the State Registration Authority.

Taxpayer registration: When a company is registered, its representative shall register with the respective tax department within 14 days having submitted the following documents as provided for by the relevant law and regulations. They are:

- Application form;

- Original and a copy of the state registration certificate; and

- Original and a copy of the charter.

Obtaining permission for strategic sectors: If a foreign state owned legal entity holds 33 or more per cent of the total shares issued by the legal entities of Mongolia (a foreign invested company) operating in the following sectors, it shall obtain a permission from the Investment Authority:

1. Mining;

2. Bank and Finance;

3. Media and Communications.

If a foreign state owned legal entity is going to hold less than 33 per cent of the total shares issued by the legal entities of Mongolia (a foreign invested company), such a permission is not required.

Documents required to establish the representative office of a foreign company: Pursuant to the Law on State Registration of a Legal Entity, a parent company or individual(s) shall prepare the following documents. They are:

- Application form (UB-13 Form);

- Decision of the parent company to establish the representative office and appoint the Director with certified Mongolian translation;

- Relevant permission where the parent company is required to obtain a permission from the authorised organization to establish representative office in foreign country, with certified Mongolian translation;

- Passport copy of the Director of the representative office;

- Profile and charter copy of the parent company with certified Mongolian translation;

- Copy of the state registration certificate copy of the parent company with certified Mongolian translation;

- Charter of the representative office charter (2 copies in Mongolian, 1 copy in any other chosen language);

- Receipt of payment of the state stamp duty of 1,100,000 tug rugs or about 447 USD; and

- Power of Attorney (if applicable).

The authorised representative of the representative office can order the seal on basis of the state registration certificate of the representative office and open bank accounts with a commercial bank.

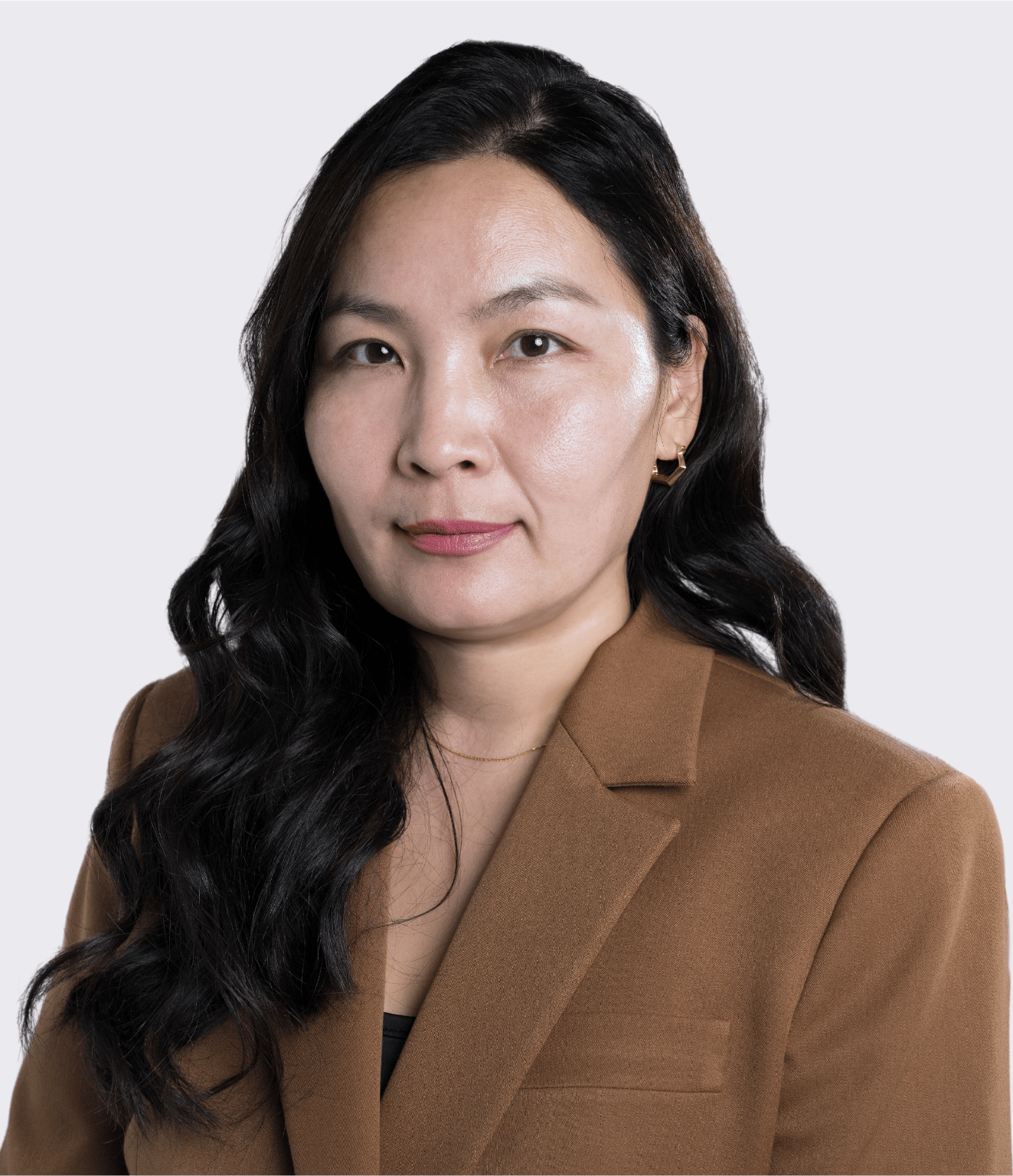

If you need more information or have any inquiry, please feel free to contact V. Bolormaa, Partner and Advocate of Absolute Advocates Law Firm by bvolodya@gratanet.com or 976 99085031.