GRATA International Legal Series (GILS): Tax law

The GRATA International Legal Series (the “GILS”) is a distinctive legal handbook, offering essential legal insights and practical tips for conducting business across jurisdictions where GRATA International operates.

Legal experts within the GILS framework have meticulously prepared a review of the legislative framework on the topic: Tax control and appealing its results.

The fourth edition of GILS is dedicated to Tax law and covers the key issues of tax control in 10 jurisdictions: Belarus, Georgia, Kazakhstan, Moldova, Mongolia, Russia, Turkey, Turkmenistan, UAE, Uzbekistan.

In this edition of GILS you will find information about tax control, its various types and forms, as well as procedures for the judicial settlement of tax disputes.

GRATA International team consists of specialists with solid experience of working in tax authorities, who have established themselves as top lawyers in interacting with government bodies on various tax matters, including tax audits and appealing their results.

You can view individual responses from each country using the links in the list below.

List of countries and authors:

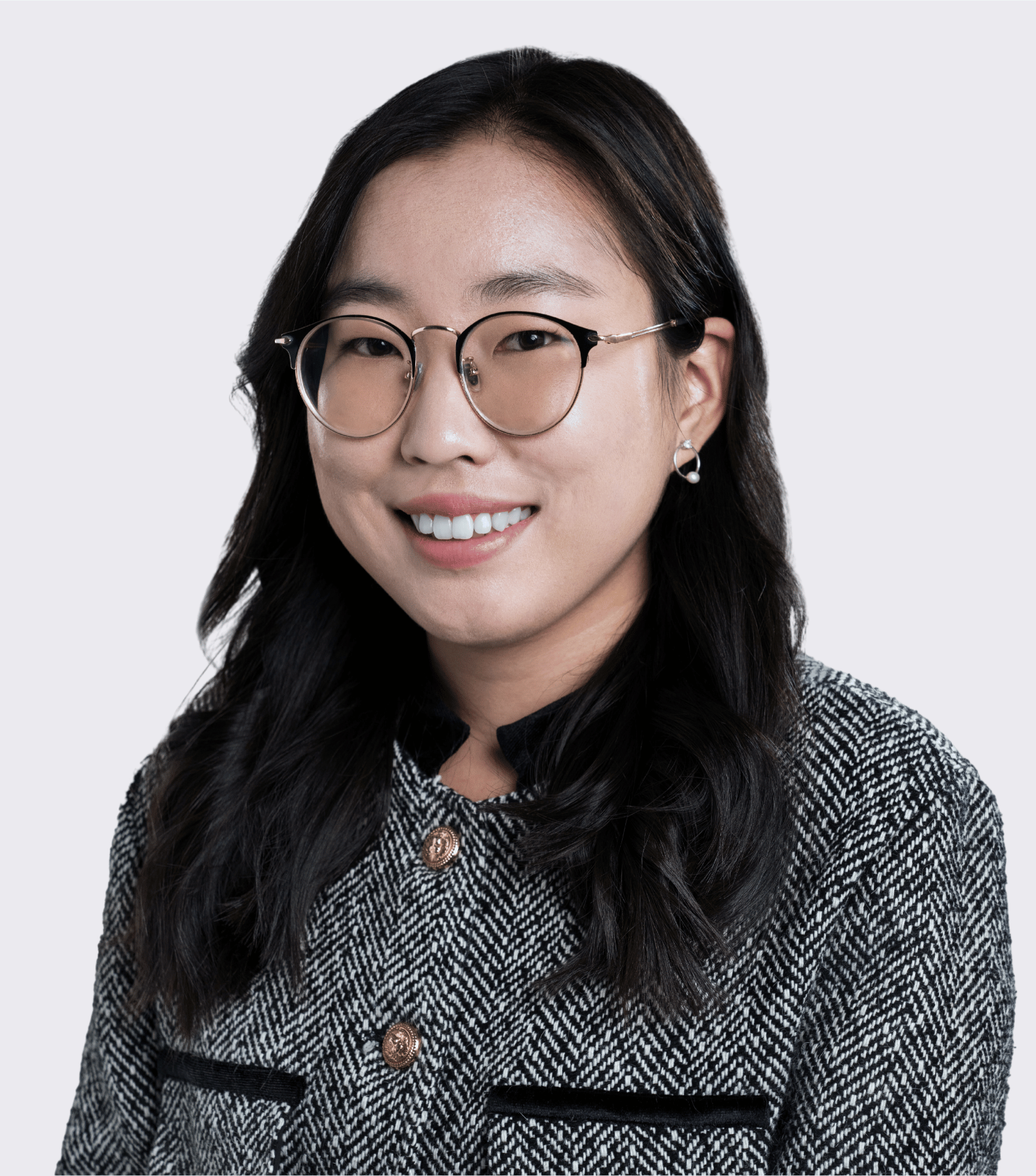

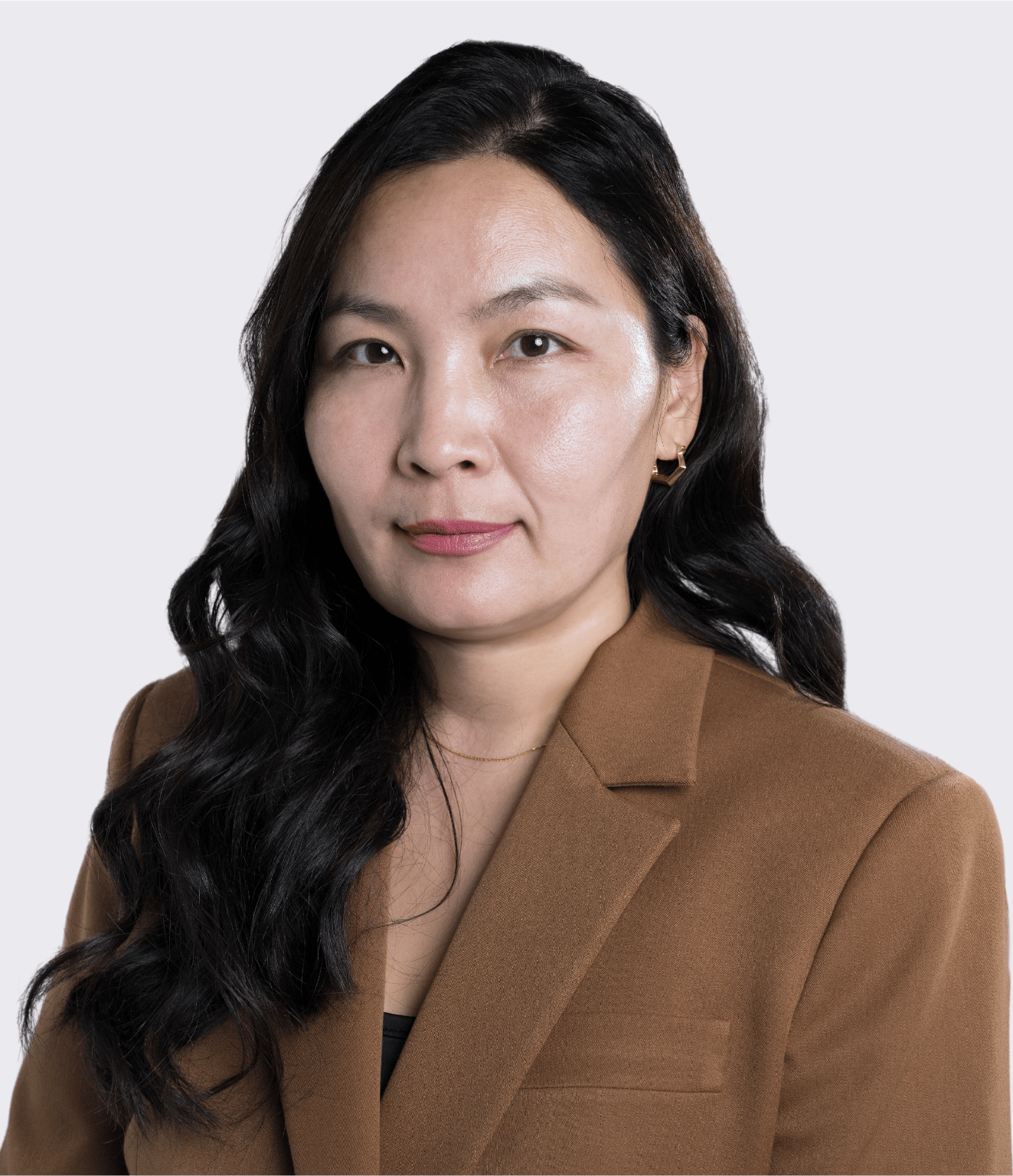

Mongolia - Bolormaa Volodya, Enkhzaya Ganbaatar;

Turkmenistan - Ikbal Said Alauddin, Vepa Kadyrov, Annamenli Rozymyradova;

UAE - Sarah Rizwan;