27

countries of presence

34

years of experience

260 +

professionals

15 570 +

clients

44 290 +

projects

NewsGRATA International Ranked in Chambers Global 2026 GuideGRATA International has once again been recognized in Chambers Global 2026, strengthening its position both at the firm level and for individual lawyers in Armenia, Azerbaijan, Georgia, Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan, Turkmenistan, and Mongolia. This year, GRATA improved its rankings in Armenia and Georgia, with individual lawyers receiving recognition in each jurisdiction.Read more

NewsGRATA International Confirmed as a Leading Law Firm in Mongolia by The Legal 500 2026The Legal 500, widely recognized as the world’s largest legal referral guide, has recently released its Asia-Pacific 2026 rankings, confirming GRATA International’s continued prominence in Mongolia’s legal market. Our office in Ulaanbaatar has been ranked in Tier 3, reaffirming GRATA’s status as one of the leading law firms and expert advisors in the country.Read more

NewsGRATA International Maintains Leading Positions and Enhances Regional Influence in Chambers Asia-Pacific 2026 GRATA International has demonstrated strong performance in the Chambers Asia-Pacific 2026 Guide, maintaining its rankings across key practices in Azerbaijan, Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan, and improving its positions in several of them. This year, the Firm has also proudly expanded its presence in the Guide with new rankings in Mongolia and Turkmenistan.Read more

PublicationsTax and Legal Implications of Engaging Freelancers for BusinessesGRATA International introduces a comparative overview of the tax and legal implications of engaging freelancers for businesses.

The publication covers multiple jurisdictions, including Belarus, Cyprus, Georgia, Kyrgyzstan, Malaysia, Mongolia, Philippines, Russia, Tajikistan, Thailand, Türkiye, and Turkmenistan.Read more

EventsGRATA International will hold a joint legal seminar in China with the international law firm AshurstThis joint seminar by GRATA and Ashurst is designed to explore the vast, untapped opportunities for Chinese enterprises in BRI infrastructure projects across the Greater Central Asia region. Read more

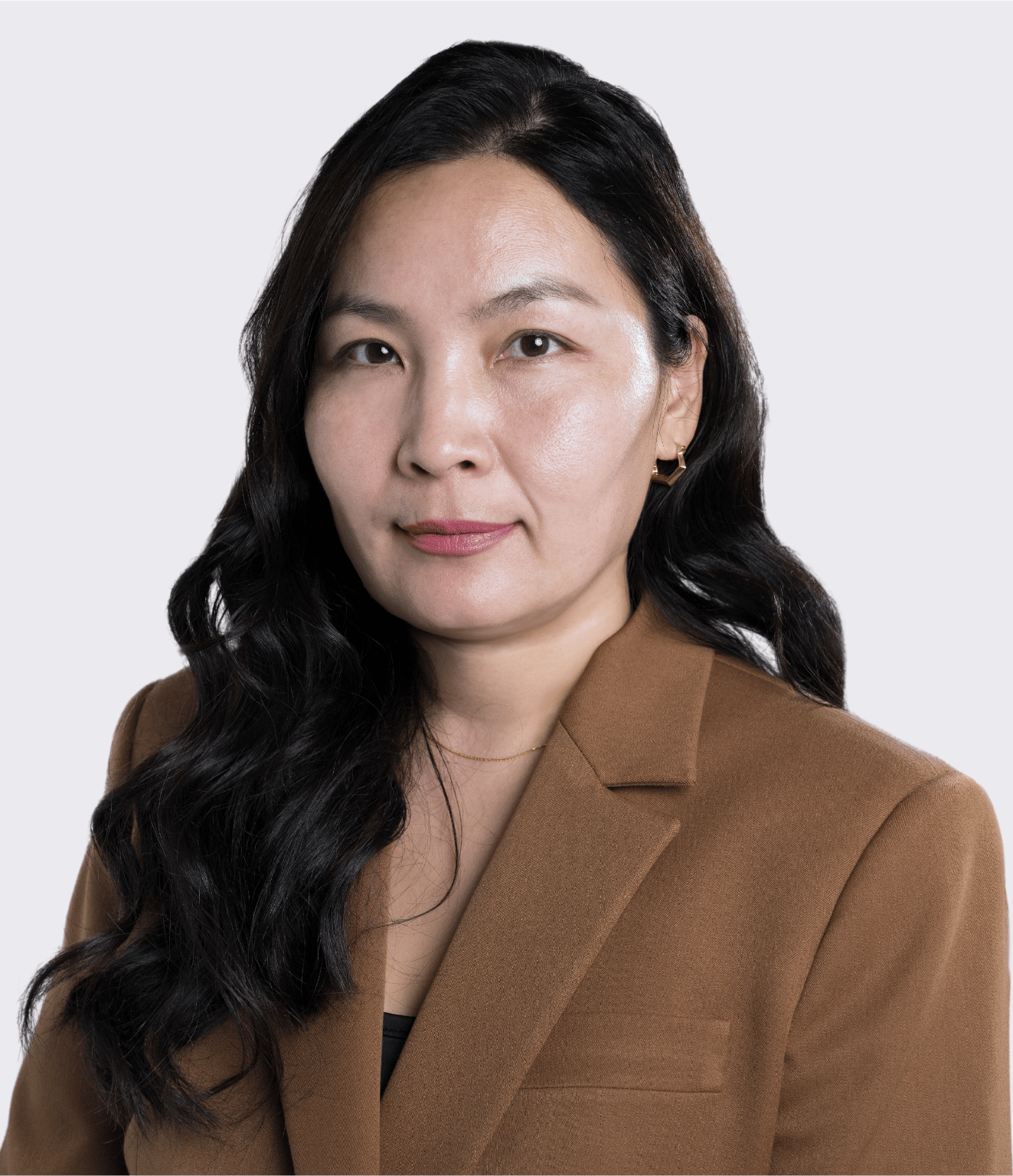

Key contacts

Choose office

Choose office

Ulaanbaatar